IRS Rolls Out Program to Combat Tax Debt Crisis

Are you feeling crushed by tax debt? You're not alone. Every year, countless Americans find themselves struggling with overwhelming tax burdens, uncertain of where to turn for relief. Fortunately, there’s a solution — the IRS Fresh Start Program. This government initiative is designed to help people regain control of their...

What to Do If You Didn’t File Your Taxes By April 15

Here's a comprehensive guide on what to do if you missed the tax filing deadline.

What to Do If You Didn’t File Your Taxes By April 15

Tax Day has come and gone, and you forgot to file. Now what? If April 15 passed without you filing your taxes, there's no need to panic. Here's a comprehensive guide on what to do if you missed the tax filing deadline. 1. Assess Your Situation Before taking any action,...

4 Signs a Tax Relief Company is a Scam (and How to Actually Get the Help You Need)

The IRS is offering tax relief to more people than ever before through the Fresh Start Initiative, and it seems everyone from local businesses to national corporations are coming out of the woodwork to sell you a miraculous solution to your tax debt problem. But there’s something a lot of...

Got an IRS Notice? Here’s What to Do.

If you received an IRS notice each year, you’re not alone. The Biden administration continues to push for IRS budget increases to ramp up enforcement on delinquent taxpayers, stoking anxiety among millions of Americans who haven’t filed their taxes or owe a balance. When taxpayers fill out our Tax Relief Survey,...

No IRS Letter? Don’t Assume You’re in the Clear.

The IRS may be sending out fewer letters this year, but that’s bad news for taxpayers who owe, experts say. While the Internal Revenue Service struggles to process millions of tax returns and paper mail that accumulated during the COVID-19 pandemic, it has opted to send out fewer automatic collection...

IRS: Time is Running Out For Tax Dodgers

If you haven’t paid your taxes or filed a tax return in recent years, the IRS may soon have more manpower to track you down and force you to pay. The Biden administration recently advanced a bill that would increase the IRS’ budget by more than $80 million over the...

The Federal Government Has Expanded Eligibility For Tax Forgiveness, But Few Have Applied.

If you owe back taxes, an Internal Revenue Service (IRS) program that is now available to more Americans than ever could help give you a clean slate.

The IRS Is Starting to Collect Unpaid Taxes And Your Account Could Be Next.

The COVID-19 pandemic upended the world in 2020, causing staggering unemployment rates in the U.S. and beyond as businesses closed in an effort to combat the virus. But as the world begins to return to normal, the IRS is, too, and that means collections on unpaid taxes are also starting...

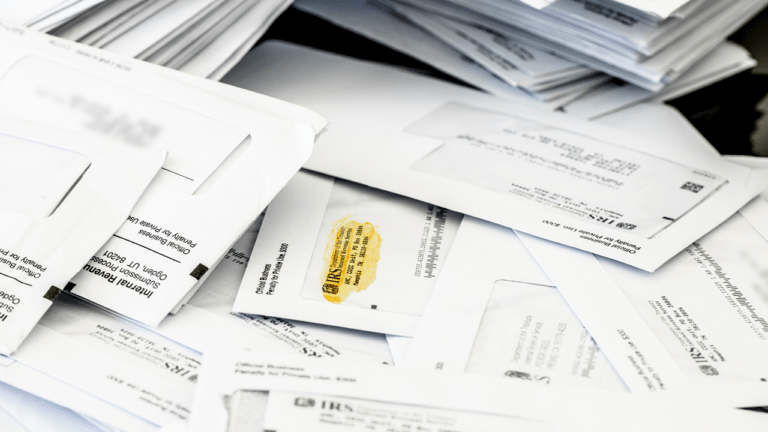

The IRS Backlog Could Benefit You. Here’s How.

When the IRS shut down along with the rest of the U.S. during the onset of the COVID-19 pandemic, its offices accumulated a mind-boggling 11 million pieces of unopened mail. As the agency reopens and is working to catch up on all of that correspondence, the inevitable delays could work...